Different states in the USA have their own unique (and sometimes weird) ways of generating income, whether it is to influence behavior or take benefit of key local industries. From tax on blueberries in Maine to candy in Illinois, you never know what thing is subjected to tax. Check out these 19 weird tax laws around the US (you might even get a chuckle from a few of these tax laws):

Hot-air Balloon Tax in Kansas

You are exempted from tax if you want to soar above the earth in a hot-air balloon, but if you want the security of staying attached to the ground while in the air, it will cost you some extra money in the state of Kansas. In Kansas, riding a hot-air balloon that is tethered to the ground is subject to the amusement tax. However, if it is not tethered, it is considered transportation, hence exempted from tax.

Jock Tax in California

Jock tax is just another name for income tax in California. It was first imposed there in 1991 after LA Lakers lost the finals from Chicago Bulls. So, whenever a high-paid player makes some money on those games in California, he/she will be subjected to the California State Income Tax.

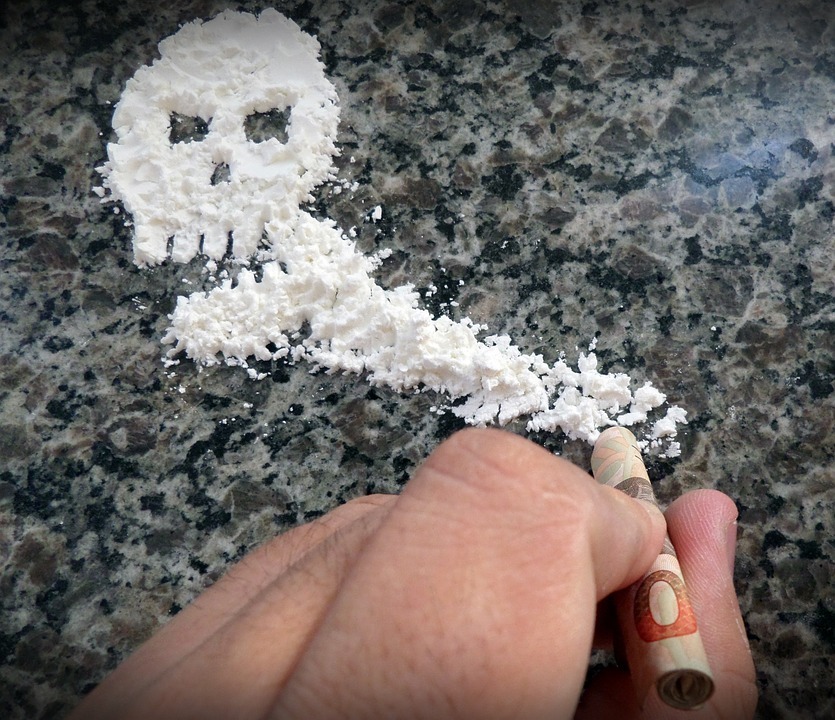

Taxing Illegal Drugs in Alabama

The state of Alabama profits from the sale of illegal drugs by requiring tax stamps, which is similar to the excise tax imposed on cigarettes. A seller caught with large quantities of illegal drugs won’t just face jail time but also prosecution for tax evasion.

Ice Tax in Arizona

Ever wondered paying tax on ice? Well, some types of ice are taxed in Arizona. For instance, they don’t consider a block of ice food, so they tax it. On the other side, small ice cubes are considered food, which means you won’t have to pay a tax for it.

Bagel Tax in New York

People of New York love eating bagels. However, you have to pay an eight-cent tax for an “altered” bagel in the state. Altered bagel is pre-sliced, has spread with cream cheese, or otherwise specially made for you. If you want to save your tax money, you will have to buy uncut bagels and then prepare them at your home.

A Confederate Veterans Tax in Alabama

The last veteran of World War I died back in 2011, but the weird thing is that the state of Alabama still taxes a Confederate veterans tax. The war ended in 1865, and its surviving veterans also died many years ago. However, taxpayers still pay this tax because once a tax is set in place, it won’t be easily curtailed. This tax was supposed to support the Alabama Confederate Soldiers’ Home, which was shut down decades ago.

However, the tax is now used to maintain the Confederate Memorial Park.

Blueberry Tax in Maine

Maine, being the country’s main distributor of blueberries, takes a cut from anyone who grows, purchases, sells, or handles blueberries within Maine. They charge 1.5 cents per pound.

Tax on Loud Music in Nevada

Places that provide instrumental or vocal music at low levels can enjoy their entertainment tax-exempt because they don’t interfere with casual conversation. However, venue owners that like to play a bit more energetic music in a loud volume will be subject to Nevada’s Live Entertainment Tax.

Vending Machine Tax on Fruits in California

If you want to eat healthy and avoid getting a candy bar or a pack of chips from the vending machine, then you might want to go for fruits. However, the problem is that picking sliced apples or fruit salad from the vending machine in your office or anywhere else is subjected to tax in California. The best way to tackle this weird hefty tax is by buying fruit from a grocery store.

Candy Tax in Illinois

If you have a sweet tooth and live in Illinois, then you have to pay a little extra to get your hands on your favorite candy without flour in it. Weird, right? Well, this is because the state takes a 6.25% candy tax if you are buying confectionery treats made without flour. If you are buying Kit Kat or Twix, you are good to go, but if you want to buy M&Ms and Skittles, add that 6.25% tax.

Tax on Altering Your Body in Arkansas

If you are living in Arkansas, then you might want to keep your body natural – means no tattoos or body piercings. If you can’t resist altering your body, then you have to get them outside the state. Getting tattoos, body piercings, and electrolysis are subjected to a 6% tax.

Playing Card Tax in Alabama

Do you know why Alabama isn’t known for its casinos? The tax on playing cards might be the culprit. The state of Alabama is the only one in the union that charges 10-cent playing card tax for cards purchased within the state. Want to know another weird thing about this tax law? Nevada, on the other hand, issues a free deck of cards with every tax return filed.

The Cost of Safety in Centennial State

If you are going to Colorado, then you have to keep one thing in mind when taking a full cup on the go. Retailers in Colorado aren’t taxed on the purchase of cups but lids and straws. Other items, such as portion dividers, cup sleeves, bibs, and toothpicks, are also subject to this weird tax law.

Tax on Diapers in Connecticut

Yes, children’s disposable and reusable diapers are taxed in Connecticut as they are considered clothing there. However, diapers, adult diapers, and feminine hygiene products are tax-exempt.

Use Tax in Iowa

If you are moving to Iowa, then you should know that the state charges a use tax for the use, storage, or consumption of something there, and you should pay it no matter where the purchase of the product was made. While on a visit, if you have purchased a laptop in Iowa that didn’t charge sales tax, the buyer will still need to pay a use tax when returning home.

However, prescription drugs and medical devices, such as catheter trays, oxygen equipment, etc. are exempted from this tax.

The Belt Buckle Tax in Texas

Dressing like a cowboy in Texas sounds great, but you have to pay a little extra in the form of tax when buying a belt buckle there. However, you won’t have to pay extra taxes on your other cowboy essentials, such as a hat, boots, belt, or other parts of your cowboy look.

The Patriotic Tax in West Virginia

Want to get into the business of selling sparklers and holiday novelties in West Virginia on the Fourth of July? You have to pay a state tax to get your certificate to sell sparkles and holiday novelties there. However, there is no tax on buying these items, only when you are selling them.

Tax on Fountain Soda in Chicago

If you are in Chicago and want a drink from the soda fountain, then you need to think again. This is because soda cans carry a 3% tax while soda from the fountain rings up at 9% – which is triple the tax rate. This extra tax is due to the syrup used to make fountain soda.

Toilet Flush Tax in Maryland

This tax is as weird as it sounds. Going to the bathroom in Maryland isn’t safe from absurd taxes, either. You have to pay roughly $60 tax per year, known as the Chesapeake Bay Restoration Fee.

Container Tax in Michigan

If you want to buy a new container to use for shipping and delivery, you have to pay tax as defined by the Michigan government. However, you can get away from this tax by buying a used container because “resale” containers are tax-exempt.

Conclusion

While paying tax is inevitable, be thankful that you don’t have to pay these weird taxes per blueberry or candy. We hope that you like this list of weird tax laws around the US. Plus, keep them in mind when visiting one of these states.