Using the Amazon platform, sellers now have the ability to trade outside of their own countries. When selling on Amazon as an international seller, there are important requirements sellers must follow to ensure a great experience for customers.

Understanding and complying with these requirements is essential for successful international selling and is required for participation in Amazon’s international selling programs.

Before You Begin

Before a seller can begin trading on an international Amazon platform they must:

- Provide a bank account in a country supported by Amazon in order to get paid.

- Understand local laws.

- Only list and sell products that comply with local laws.

- Confirm they can deliver to the customer on time, every time.

- Confirm they can provide customers with after sale support.

Obligations for Every Product

Every product that a seller promotes or sells on an Amazon marketplace website must meet the following standards:

Customer Expectations. Provide customers with accurate product location and shipping information.

Delivery to the Customer. Use a reliable shipping method so customers receive their purchases on time, every time.

Customer Service. Be prepared to respond quickly to customers, in the language of the Amazon marketplace website in which they are registered to sell.

Note: If providing phone support, sellers are required to do so in the language of and within the business hours of the time zone of the Elected Country.

Right to Sell. The laws of each country are different (and laws may vary within countries). Sellers must be permitted to offer, promote and sell any given product.

Listings. List products using the primary language and currency of the Amazon marketplace in which they are registered to sell.

Customer charges. Include all applicable charges and taxes (including VAT, customs duty, excise taxes, etc. as applicable). Provide VAT invoices to the customer upon the customer’s request, if applicable.

Returns. Adhere to Amazon’s international return policy.

Taxes. Sellers are solely responsible for:

- determining whether any taxes apply,

- accounting for any taxes due, and

- reporting as often as necessary to the appropriate tax authority.

Selling Agreement. At all times, sellers must comply with the terms and conditions of their selling agreement.

Obligations for FBA Sellers

To participate in the FBA program, sellers should comply with all of the following:

Delivery of Inventory. If a seller chooses to send inventory directly to Amazon from outside their Elected Country, they must use an import broker (either one of their own or one designated by Amazon).

All inventory sent directly to Amazon from outside the Elected Country must be sent under “Delivery Duty Paid destination” freight terms with all relevant import duties and other taxes paid.

Amazon will not be responsible for any import duties, taxes, collect freight or miscellaneous charges associated with importation into the Elected Country.

Surety Bond. If a seller chooses to send inventory directly to Amazon from outside the Elected Country, they will need to obtain an import surety bond.

Importer and Consignee. If a seller chooses to send inventory directly to Amazon from outside the Elected Country, they must list themselves as the importer and consignee, not Amazon. Amazon will not act as importer of consignee of this inventory.

Return Shipping Address. Amazon is currently unable to return FBA inventory to an address outside of the Elected Country. Furthermore, the FBA service does not currently support pick-up options for sellers at Amazon fulfilment centers.

If a seller wishes to have their inventory returned to them, they must supply a return address within the Elected Country.

Taxes. By having inventory within the Elected Country, sellers may be liable for certain taxes in the Elected Country.

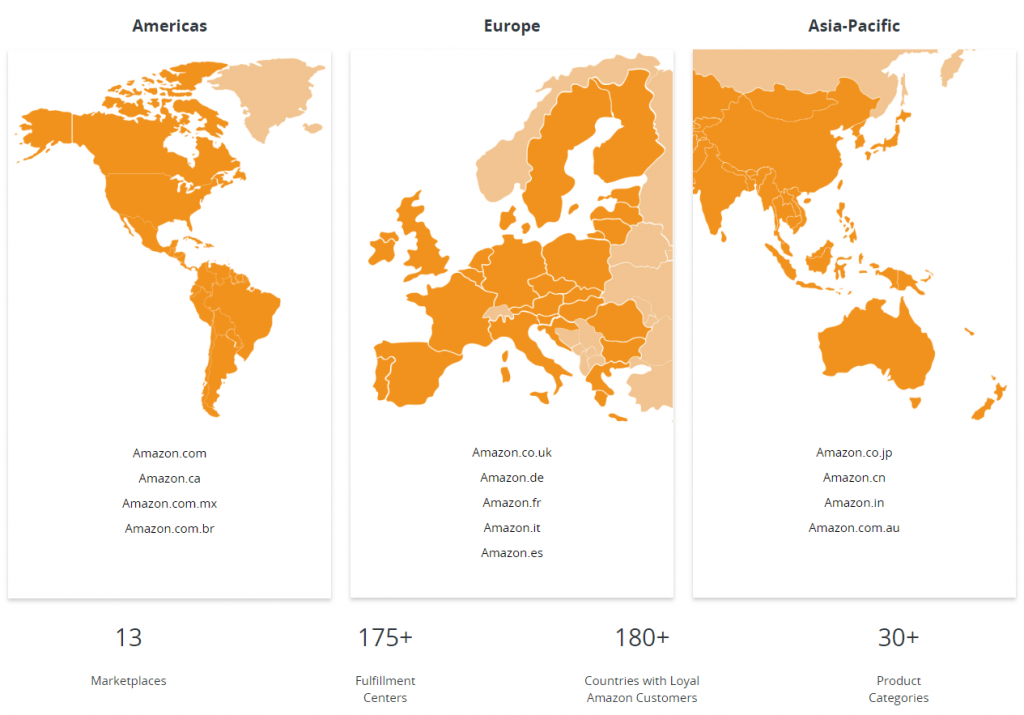

Amazon World Footprint

*To see a complete breakdown of the rules and guidelines for each of the international Amazon markets click here.