After State Farm, Allstate Insurance is the second largest insurance firm in the United States. It’s also the largest publicly-held personal lines insurer. It has made innovations not only in terms of selling insurance but in conducting customer services as well. It even influenced safe driving across the nation.

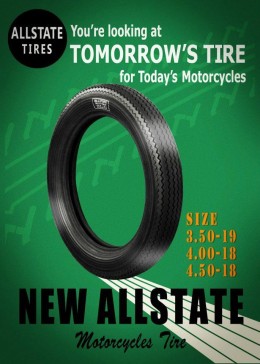

It’s origins as a car tire brand to auto insurance arm of Sears, Roebuck, and Co.

Allstate was formed in 1925 as part of Sears, Roebuck, and Co., which was then looking to expand and diversify beyond its line of department stores. Initially, Allstate was formed as Sears’ car tire brand – and the tires eventually contributed to Allstate’s success.

In April 1931, Allstate introduced auto insurance, naming it All State Insurance Company. It was the first to adopt selling insurance through direct mail and also via the Sears catalog. The marketing strategy worked for the company very well, as it enabled people to take their time to review the insurance being offered and the applications without facing the pressures of a salesperson, as well as in the comfort of their own homes.

Promoting auto safety

The auto insurance business quickly became popular; so much so that Sears decided to put up offices in their department stores. In this way, Allstate could market insurance to more people, giving them ready accessibility to its services. Allstate was also among the first to adopt a rate classification that is based on the person’s driving history. This means that if you’ve got a good driving record and are overall a safe driver, you’ll be given better insurance rates. This idea was a big success because AllState, in a way, advocated and promoted safe driving. The approach was such a hit that other auto insurances followed suit.

Diversifying its insurance services

As the years and decades went by, Allstate went beyond selling only auto insurance by including other insurance such as home insurance, fire insurance, and life insurance. The company also started setting up businesses in Canada in 1953. Allstate attempted to enter into the auto market during the early 1950s but this move didn’t take off. So it decided to continue focusing on insurance and selling tires.

Allstate revolutionized the processing and disbursing of automobile claims. During the 1950s it set up its first drive-in claim office for the convenience of customers who could obtain their claims without getting out of their automobiles – thus propping up vehicle safety. The company also successfully persuaded the government to pass the safety belt law, although safety belt laws vary from state to state.

By the 1960s, the Allstate brand continued to sell insurance as well as car tires and car batteries. In the 1970s, Allstate evolved into a company selling only insurance. Its wide reach continued as it had already added mortgages and various financial services.

Allstate Insurance as a separate company

During the early 1990s, the Allstate Insurance Company went public, launching one of the biggest initial public offering (IPO) in US business history. In 1995, Sears spun off its remaining stake of Allstate to its shareholders, leading the insurance company as a separate, independent firm. The following year, Allstate went to cyberspace by launching their official website.

In 1999, Allstate acquired CNA Personal Insurance and later renamed it Encompass Insurance Company; it also purchased American Heritage Life Investment Corporation which Allstate renamed Allstate Workplace Division. Recently it also became a sponsor in many sporting events and set up call centers across the country.

Allstate has been the inspiration behind many changes for the auto insurance industry, including but not limited to direct mail insurance, promoting safer driving, and safety belt usage. In 2006, the insurance company launched “Keep the Drive” which was an initiative to encourage teen-to-teen smart driving. The initiative addressed the number one killer of teens across the United States – car crashes. The following year, Allstate introduced “Teen Safe Driving Campaign” which offered a parent-teen driving contract aimed at preventing teen driving deaths.

To date, Allstate’s popular services include homeowners insurance, life insurance and, of course, their auto insurance. As of 2016, Allstate boasts $36 billion in total revenue, of which more than $20 billion are property-liability premiums. It continues to serve tens and millions of households, with about 15,000 agents ready to serve to the customer’s needs, thus holding true to its slogan “You’re In Good Hands” with Allstate.